Nowadays the number of organizations managed as holding companies is increasing. This managerial method succeeds as a result of vertical development and expansion, decreasing and managing risks in various business lines, protecting legal entities of other subsiding companies, the strategic focus in every business, use of taxation facilitations, etc. However, this organizational management approach faces some challenges too.

One of these challenges of the diversity of holdings is accessing integrated online reporting in these organizations. Based on its operational need, each company has processes and subsystems for management and reporting, which are not integrated based on their form and content at a holding level. In addition due to not being updated often, each firm does report with its specific method, and there is even the probability of contradiction in companies’ reports. The risk of contradiction in reports is specifically high in cases where holdings have inter-company transactions, and each company operates independently registering its data.

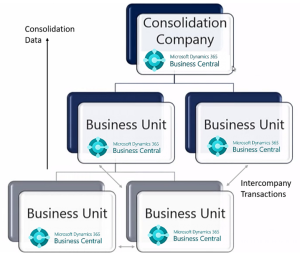

One of the recurring needs of holding companies is combined financial statements. Combined or Consolidated financial statements are financial statements in which assets, debts, shareholders’ rights, revenues, costs, and cash flow of the holding company and subsiding companies are presented as financial statements of a single economic unit. Combined financial statements offer an excellent view of an organization’s operation and to prepare is we need both standardized processes and Software requirements which are available in Dynamics 365 Busines Central.

Another point we should consider about challenges in managing of holding organizations is the process standardization due to the organization’s data. Imagine a process like the purchase process in each subsidiary company of a holding is done differently, based on people’s decisions and in a solitary system. As a result, in addition to hidden expenses like support and maintenance costs of various information systems and recurring reworks, it is challenging to make integrated, online, and consistant reports on a holding level and, in addition to possible delay in preparing the report, the authenticity of data and reports might also be questionable.

What is the holdings’ proper approach to satisfy these requirements?

Holdings must fix and integrate their processing and systemic frameworks to solve these issues. To this end, it is necessary to design a proper architecture for the data flow at the holding level so that online access to needed reports may be possible for any single company or accumulatively. We should be aware that although reviewing and engineering processes are beneficial in standardization, so long as we don’t implement these standard processes in standard and integrated tools in the organization, they will not be enough to solve the issues.

Another point is that the properties of the intended integrated tools must support the holding’s requirements, such as producing combined financial statements and intercompany transactions, so that financial standards are met and result in online and authentic output. Also, on the other hand, some holdings and specialized parent companies have entered the stock market or have a mid or long-term plan to enter it. Thus, standard tools are necessary to present an standard output to stock market such as the XBRL reporting system.

The proper solution for holdings must be enough to fulfill the requirements to be comprehensive for current, and future needs since holding organizations’ system changes do not come easy and involves lots of time, money, and work. Therefore, establishing the proper system of holdings to cover all these needs is an essential and fundamental choice.

The Problem of intercompany Transactions and consolidated reports in holdings and the Microsoft Dynamics 365 Business Central solution

The Business Central solution presented by Microsoft is a standard international, multilingual, and multi-currency ERP that includes financial accounting, sales and marketing, purchase and supply, warehouse, manufacturing and production, service management, and project management. Given that this is an ERP solution based on standards and best practices of the American Productivity and Quality Center (APQC), it is standard in terms of process, and by developing this system in holdings and subsidiaries, the inter-organizational procedures will be standardized. APQC and PCF frameworks are two of the best-known standard frameworks widely accepted. Though it is clear that this solution, like any other ERP, needs analysis, consultation, and establishment of principles based on each company and holding’s needs, the key to the success of the ERP project is in its implementation. However, because of the similarities in the basis of standard-based procedures, standardization processes with the establishment of ERP in holdings is operational to a proper extent.

Also, this ERP has capabilities specific to the holding organizations’ requirements, which we will discuss further.

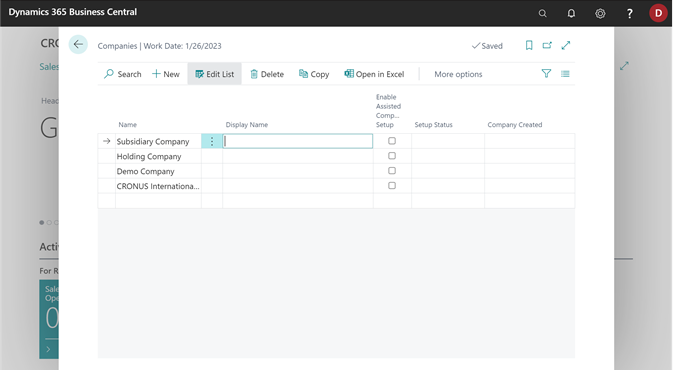

- Capability to implement as a multi-company

We can implement this ERP as a multi-company in the holding and its subsidiaries. Each company operates in its independent system and deals with its data; Also, the holding can use the 360-degree view of all companies as a interface and will have centralized reports. In addition, each user can potentially have access to different companies. On the other hand, it is possible to administer some joint and aggregated operations within the holding. For instance, we can purchase and supply between the holding and subsidiaries with each other.

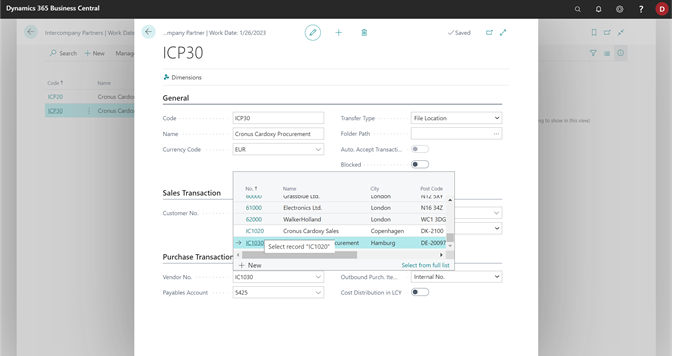

- Supporting inter-company trade and transactions

The Dynamics 365 Business Central ERP has some capabilities for inter-company transactions under Intercompany Posting or Intercompany Registrations. In addition to facilitating communication between companies, these abilities prevent rework, entering data multiple times, and contradictions between companies’ data. For instance, if there’s a sales and purchase transaction between two subsidiary companies, a similar deed will be recorded by registering a purchase deed in one company. After confirmation by the other company, the system will post the deed in the financial records for both companies simultaneously.

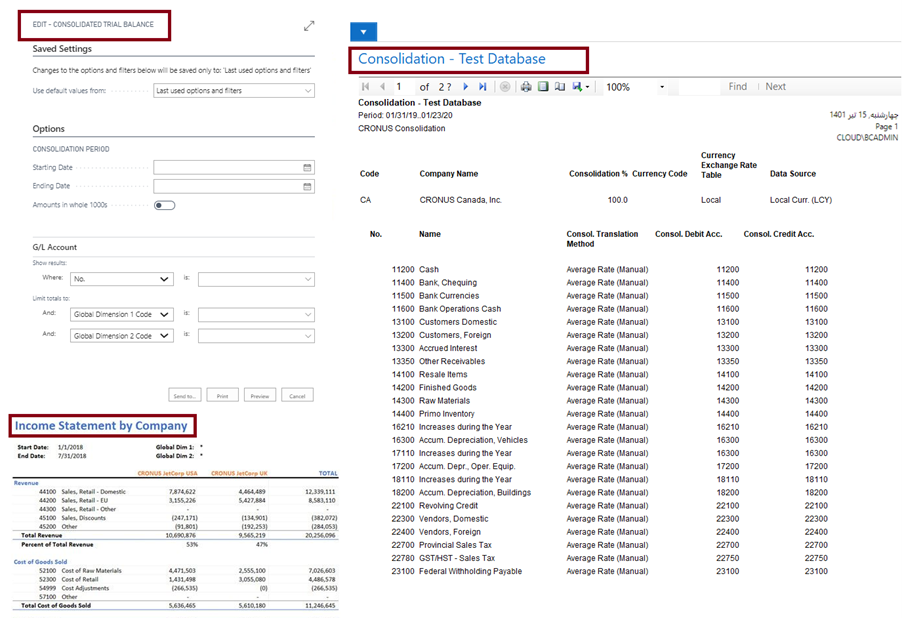

- The ability to create combined financial statements and get online consolidation reports

One of the most prominent needs of holding organizations is the ability to receive combined reports. Due to the ability to support multi-company implementation and standards required by financial accounting in this domain, the Business Central ERP can prepare consolidated financial statements like trial balance sheets at the holding level.

- Support of standard formats of financial reports for entering the stock market

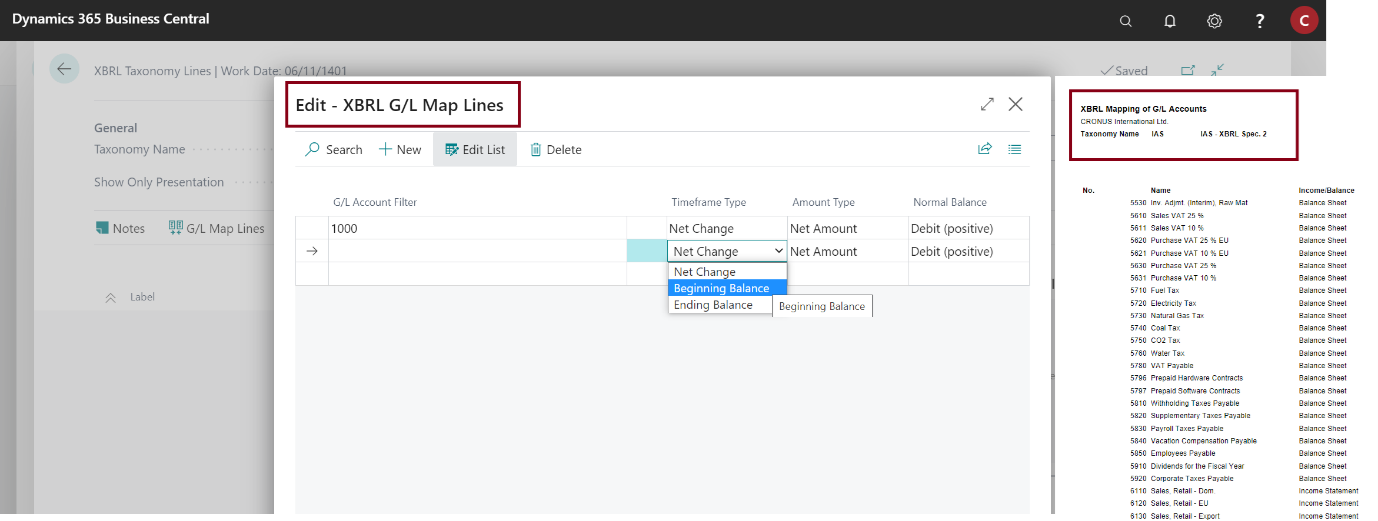

One of the visions of many holdings is entering financial markets like the stock market. One of the infrastructures necessary for this purpose is presenting formal financial statements in desired formats of the stock market system. Dynamics 365 Business Central ERP is a standard approach that supports all common financial formats like XBRL international standard format and can exchange information with those systems.

Besides the above-mentioned tangible benefits resulting from supporting holdings’ required abilities in Dynamics 365 Business Central ERP, implementing this ERP as a holding company creates hidden but crucial benefits that we will mention

briefly.

- Centralized management of information technology infrastructures and decreased support and maintenance costs at the holding level.

- Standard and accumulative data-centeric architecture for all companies with a unified and centralized database

- Standard process-based structure based on optimized and unified method for operating the same tasks for all companies

- Managing automatic processing of financial, accounting, storage, purchase, sales, etc., in a single and inter-company manner.

- Standardizing integrated reports in terms of form and content in all companies and holdings

- Controllable user access levels in all companies for shared personnel and teams

- Syncing with global business methods and standards with the implemtation of standard ERP

- Ability to provide unlimited, diverse, and ideal web services in all parts of the system (extensibility to connect to other systems).

- Standard bug-free software infrastructure in all the holding companies

- Extensibility and scalability of the approach along with the growth and development of the organization and the emergence of new needs and processes

- Existing extensive knowledge-based network for Dynamics 365 Business Central

Conclusion:

The growth and development of holding company organizations, comes with lots of benefits, but there are challenges lie ahead for the management. Some example of such challenges are non-standard processes, non-updated reports, non-standard data in subsidiaries, the possibility of discrepancies in Intercompany transactions, and the difficulty of preparing combined financial statements in the holding. To overcome these challenges, standard software infrastructures and working routines with the unique architecture of the holding’s information flow can be a solution. Dynamics 365 Business Central ERP is a standard international ERP which supports the needs of holding organizations. With the implementation of this ERP in holdings, we can standardize the processes according to international APQC, synchronize the data structure in the holding and subsidiaries, and solve the data problem altogether. Also, this ERP supports holding companies’ particular requirements, including preparing consolidated financial statements and inter-company transactions. It provides the standard infrastructure necessary for the holding company to enter the stock market with its built-in XBRL reports.